1win Payments: Deposits & Withdrawals in Ghana

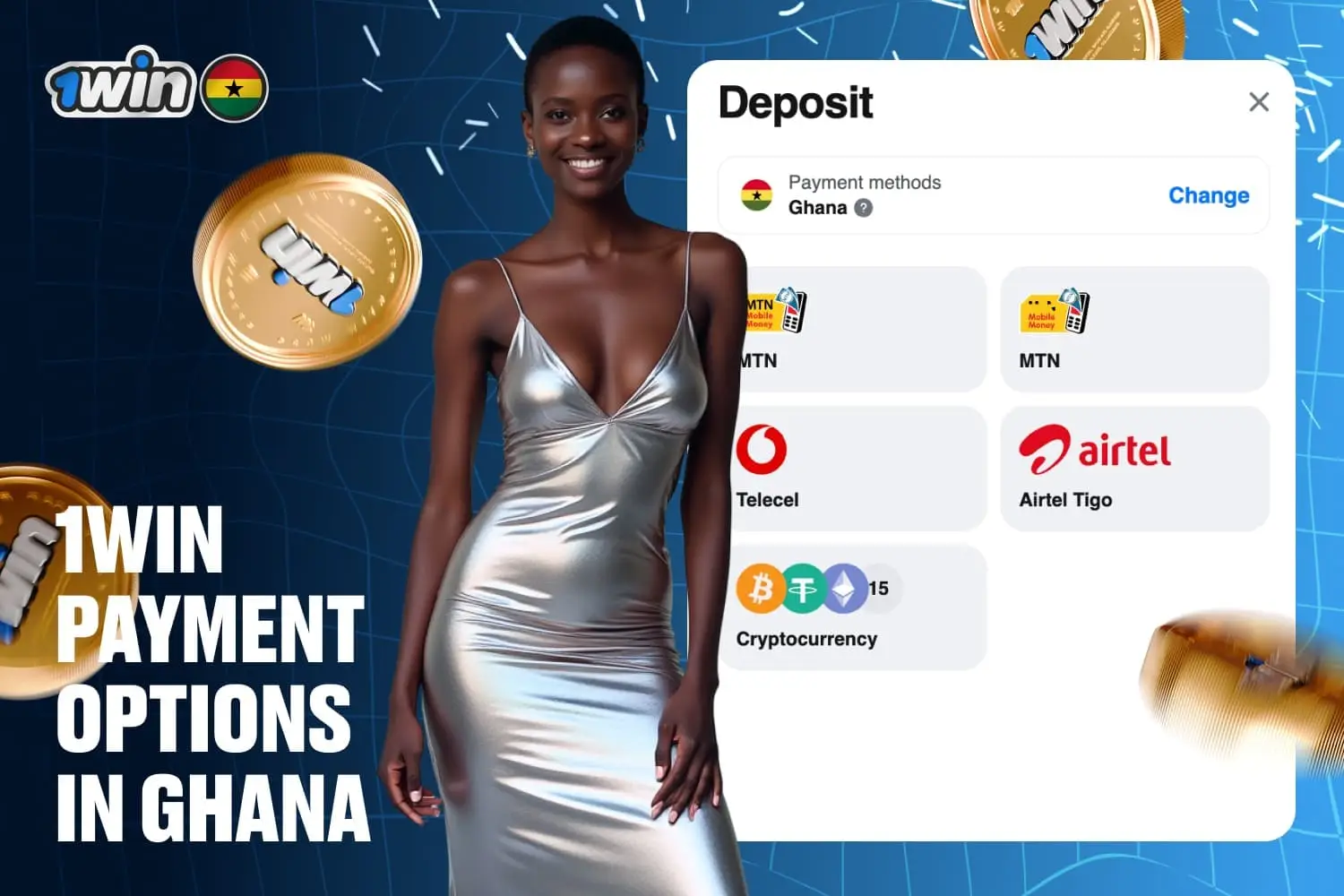

Managing your money at 1win Ghana is designed to be a secure and straightforward process. The platform is fully equipped for Ghanaian players, offering full support for the Ghanaian Cedi (GHS) and all major local payment methods. You can easily use options like Mobile Money or even cryptocurrencies to fund your account and start playing.

💰 500% Welcome Bonus Up to 7,150 GHS on your first 4 deposits!

Account Funding Architecture

The deposit system is designed to be accessible, with entry thresholds set low to accommodate a wide range of players. Users can fund their accounts instantly through a variety of channels, prioritizing those most relevant to the West African market.

Mobile Money Integration

Given the dominance of mobile financial services in Ghana, 1win has integrated directly with the major telecommunications providers. This allows for real-time transfers where funds are credited to the betting account immediately upon confirmation. The platform supports:

- MTN Mobile Money: A primary option for many users, offering instant processing.

- Vodafone Cash: Fully supported for both inbound and outbound transactions.

- AirtelTigo: Integrated to ensure comprehensive coverage across the national network infrastructure.

Alternative Payment Instruments

Beyond mobile wallets, the operator accommodates users with different financial preferences through several additional methods:

- Cryptocurrency: The platform accepts a broad spectrum of digital assets, including Bitcoin, Ethereum, Tether (USDT), Litecoin, and Monero. These transactions offer a higher degree of privacy and are typically processed within minutes.

- Bank Cards: Standard Visa and Mastercard transactions are supported, providing a familiar option for users accustomed to traditional banking.

- Electronic Wallets: Intermediary services such as Perfect Money and AstroPay allow users to manage their betting funds separately from their main bank accounts.

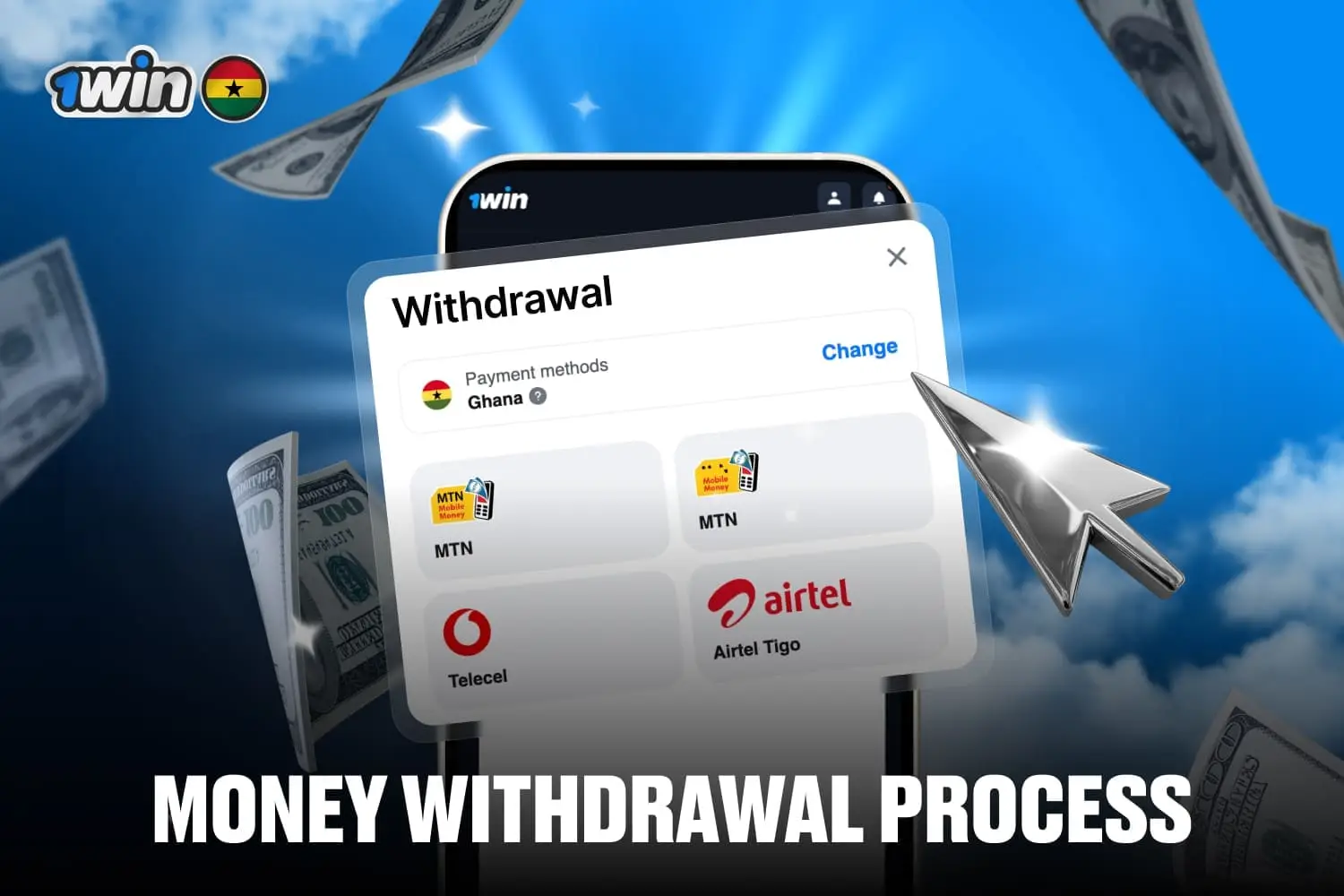

1win Withdrawal Security Protocols

The withdrawal process is designed to balance speed with security. To prevent financial fraud, the platform generally enforces a "closed-loop" policy, requiring payouts to be routed through the same method used for the most recent deposit.

Processing Timelines

The speed at which funds become available depends heavily on the chosen withdrawal channel:

- Mobile Money & E-wallets: These are consistently the fastest options. Transactions are typically processed and settled within 24 to 48 hours.

- Cryptocurrency: Withdrawals to digital wallets are often finalized rapidly, sometimes within hours, depending on network confirmations.

- Bank Transfers: Payouts directed to traditional bank accounts are subject to standard inter-bank clearing cycles, which can extend the processing time to between 1 and 5 business days.

Transaction Limits

The platform imposes specific limits to ensure financial stability. The minimum withdrawal amount is generally set at 50 GHS for mobile money and Perfect Money, while cryptocurrencies and bank transfers may have higher starting thresholds. Maximum limits vary by method, with cryptocurrencies typically accommodating the largest single transactions.

Identity Verification (KYC) Standards

While deposits are unrestricted, the withdrawal function is gated behind a mandatory "Know Your Customer" (KYC) verification process. This security layer is essential for regulatory compliance and user security.

Users must submit digital copies of specific documents via their account settings to verify their identity:

- Identity Document: A valid government-issued ID, such as a passport, driver's license, or national ID card. The image must be clear and show the entire document.

- Address Verification: A utility bill or bank statement issued within the last 90 days that confirms the user's residential address.

The compliance team reviews these submissions, typically within 24 to 48 hours. Once the account is verified, the withdrawal lock is removed.

Transactional Incentives

The operator utilizes a structured bonus program to encourage deposit activity. New users are eligible for a welcome package that matches the first four deposits by a cumulative 500%. This bonus is distributed as follows:

- First Deposit: 200% match.

- Second Deposit: 150% match.

- Third Deposit: 100% match.

- Fourth Deposit: 50% match.

These funds are credited to a separate bonus wallet and convert to real cash through active gameplay in the sportsbook or casino sections.

Operational Security and Support

1win employs 256-bit SSL encryption to protect all financial data during transmission. Additionally, a dedicated support team is available 24/7 to assist with payment-related inquiries. Users can access help via live chat or email to resolve issues such as delayed deposits or verification hurdles.

FAQ

What is the daily withdrawal limit for 1win players in Ghana?

While 1win allows large withdrawals, your mobile network (MTN/Telecel) may have daily limits. Check with your provider for limit increases.

How do I deposit money into my 1win account with MTN MoMo?

Select "Deposit," click "MTN," enter the amount, and you will receive a prompt on your phone to enter your MoMo PIN to authorize the transaction.

Why has my withdrawal not arrived yet?

Ensure your turnover requirements are met and your ID is verified. 95% of MoMo withdrawals are instant; bank transfers may take 1-3 business days.

Can I use USDT or Bitcoin for betting in Ghana?

Yes, 1win is a crypto-friendly platform. You can deposit Crypto and we will convert it to GHS so you can bet on local markets.

Are my financial details safe on 1win?

We use 256-bit SSL encryption, the same level of security used by major Ghanaian banks, to protect your transaction history.

Don't know what to play?

Try your luck in a random game